operating cash flow ratio ideal

Here is the formula for calculating the operating cash flow ratio. Cash flow from operations average current liabilities operating cash flow ratio.

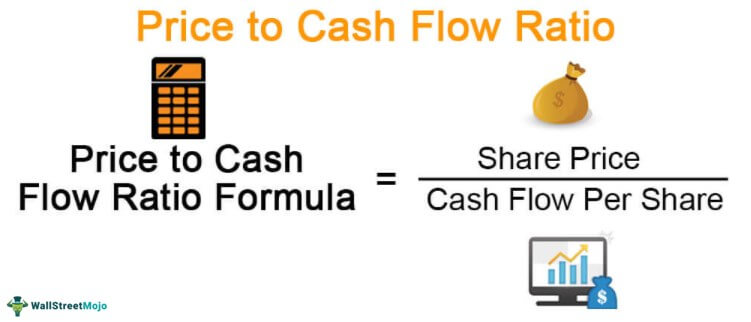

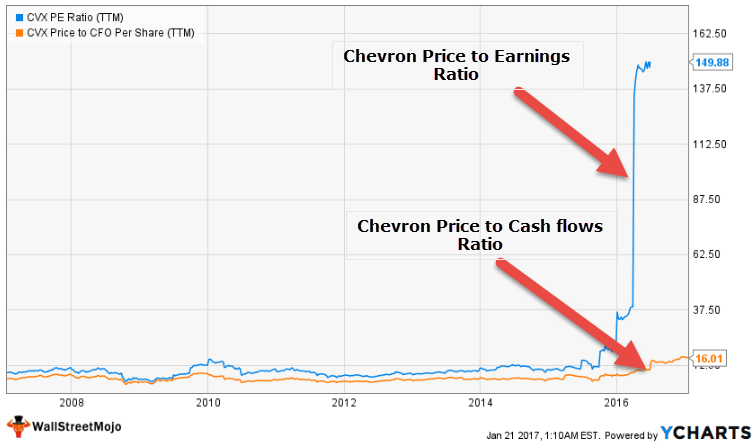

Price To Cash Flow Formula Example Calculate P Cf Ratio

This means that Company A earns 208 from operating.

. Operating Cash Flow Net Income - Changes in. It means 55 of the sales revenue would be used to cover cost of goods sold and other operating expenses of Good Luck Company Limited. Thus in this case the operating.

Operating cash flow ratio is. Interpret companys financial performance with financial ratios and balance sheets. Example of Cash Returns on Asset Ratio.

Cash returns on assets cash flow from operations Total assets. Operating Cash Flow. This is especially beneficial when the companys profits are currently quite low on certain items.

The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. It measures the amount of operating cash flow generated. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you.

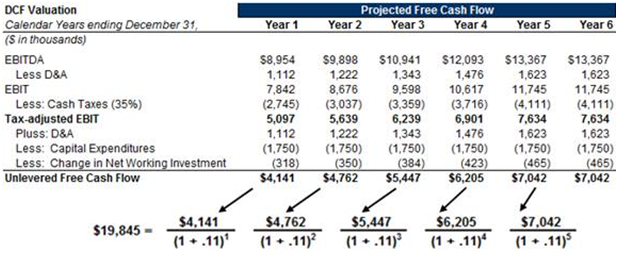

FCFOCF Ratio Free Cash Flows Operating Cash Flows x 100. Operating cash flow ratio CFO Current liabilities. You can work out the operating cash flow ratio like so.

250000 120000 208. To find the operating cash we can add the net income 3000000 depreciation 3000000 amortization 250000 change in working capital 80000 and other non-cash. This provides total cash generated.

The operating cash flow ratio is a measure of a companys liquidity. Although there is no one-size-fits-all ideal ratio for every company out there as a general rule the higher. The formula for calculation of free cash flows to operating cash flows ratio is given below.

Therefore cash is just as important as sales and profits. Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Operating Cash Flow Ratio.

Calculation formula The formula for this ratio is. Operating Cash Flow Margin. Operating Profit Ratio Operating ProfitNet Sales100.

Selectively raise prices on the goods and services being sold. Operating Cash Flow formula using the indirect method can be represented as follows. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow.

This is because it shows a better ability to cover current liabilities using the money. The operating profit ratio is 55. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time. Operating Cash Flow Margin Cash Flow from Operations Net Sales. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded.

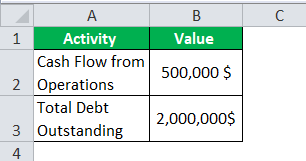

Ad Understand liquidity ratios trends to help you gauge creditworthiness of a company. A higher ratio is more desirable. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. However they have current liabilities of 120000. Operating cash flow Net cash from operations Current liabilities.

This means that for every 1 unit of net sales the company earns 20 as operating. The concept of free cash. This ratio indicates the ability of a company to translate its sales into cash.

If the operating cash flow is less than 1 the company has generated less cash in the period than it. Lets consider the example of an automaker with the following financials. A higher ratio is better.

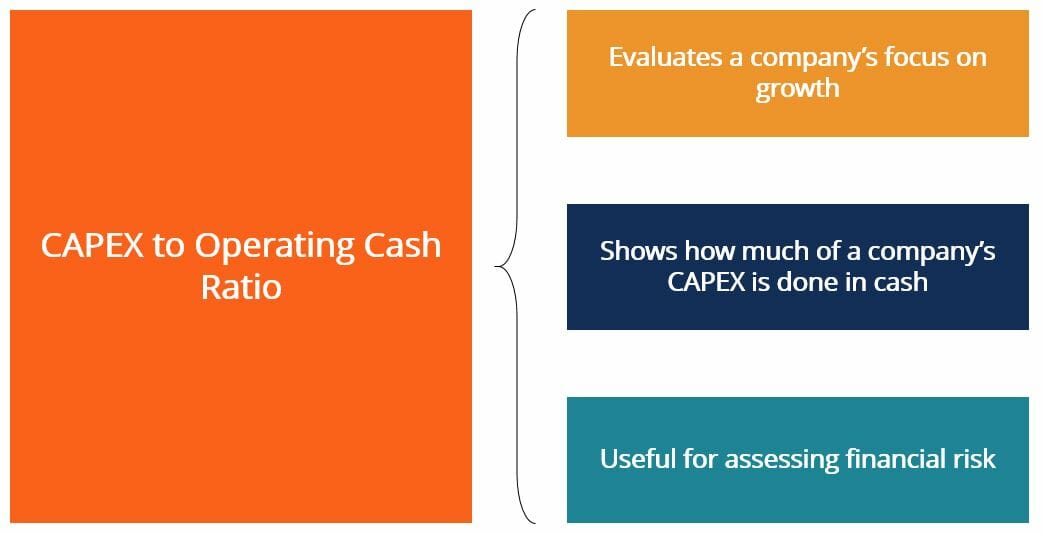

In this case the. The formula to calculate the ratio is as. The CAPEX to Operating Cash Ratio is calculated by dividing a companys cash flow from operations by its capital expenditures.

For Less Than 2 A Day Get Organized Save Time And Get Tax Savings With QuickBooks.

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Formula Guide For Financial Analysts

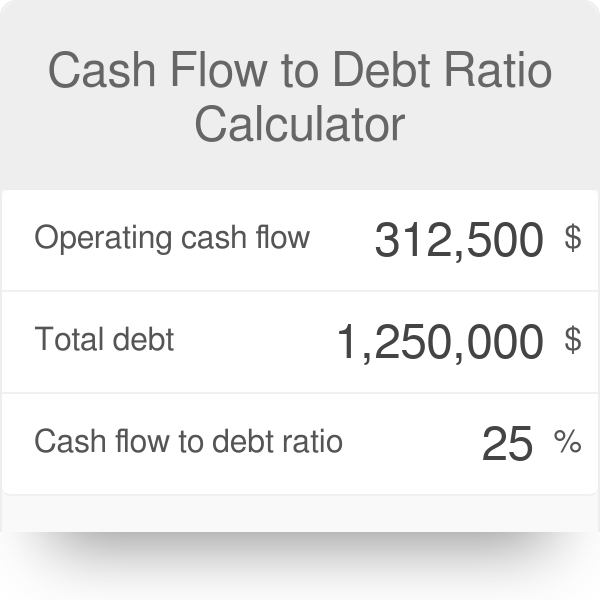

Cash Flow To Debt Ratio Calculator

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Definition Formula Example

Operating Cash Flow Ratio Calculator

Cash Flow To Debt Ratio Meaning Importance Calculation

Operating Cash Flow Efinancemanagement Com

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Cash Flow From Operations Ratio Formula Examples

Cash Conversion Ratio Financial Edge

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio India Dictionary